While working for yourself comes with countless perks, there's one major downside: You're responsible for withholding and paying your own taxes.

Preparing and filing freelance tax can be complicated for self-employed photographers. To help you navigate this process, we’ve compiled a tax guide for photographers to get you started.

Receive free ecommerce & product photography tips

How to file taxes as a freelance photographer

Start with small business recordkeeping

Before moving forward, set yourself up for success by keeping good records of everything — and we mean everything.

Some of the records and receipts you need to set aside include:

- Receipts for business-related expenses (don't worry, we'll detail deductible expenses later)

- Invoices

- Payroll records for full-time or contract employees

- Bank statements

- Any W2 or 1099 forms from employers

- Previous income tax returns

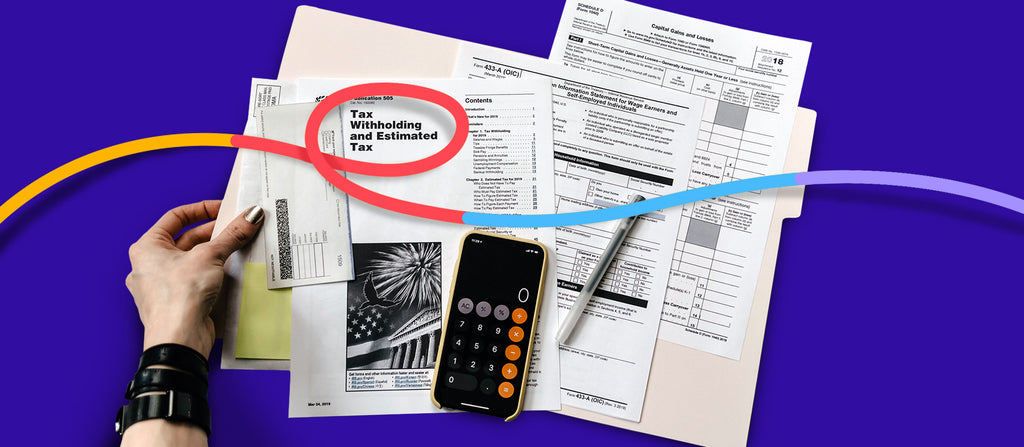

While you can hang onto all this paperwork in a shoebox for your accountant to sort out, we recommend getting organized. Set up a proper paper filing system or use an accounting tool like Wave or QuickBooks to digitize, store, and categorize paper receipts and track invoices.

To keep track of everything, Jody Siebert, an accountant at Fix Your Accounting, recommends you build two good habits: scanning and filing all your receipts.

"Scan and file all receipts by month, writing on each receipt the purpose of the expense," she says. "Credit card statements are not audit-proof and will likely result in the expenses being disallowed on audit."

Even if you're working with a pro bookkeeper or accountant, you'll need to have your important paperwork organized so that they can effectively help you.

“A tax professional can't do their job effectively without a clean set of financial statements,” said Lozelle Mathai, owner of Closing Your Books, which specializes in bookkeeping and accounting for female freelancers.

“When a freelancer has poor accounting records, the tax accountant will be forced to file taxes based on sloppy and inaccurate financial statements,” she says. “The tax accountant can't minimize the client's tax liability based on inaccurate financial statements.” The prospect of collecting and organizing all this paperwork may seem daunting, but you'll thank yourself come tax season. Accurate bookkeeping will make life easier during tax season, especially in case of an audit. As a freelance photographer who may need to rent or buy pricey equipment, market your services, and rent out studio space, you'll have a spectrum of expenses you can deduct from your taxes. There are business-related costs you can write off to decrease the size of your tax burden. To summarize some of the most common expenses freelance photographers can deduct, here's a quick list of the top deductions: As a freelance photographer, there's a lot of expensive equipment involved — from cameras to lighting to props — which make the startup costs for freelance photographers prohibitively high. Fortunately, when you purchase or rent any equipment related to your work, you can deduct those expenses. That's why it's important to track every piece of equipment you buy during the year, including cameras, lighting, stands, tripods, film supplies, lenses, and even hard drives and computers. Keep a list of all your equipment and important data (like its value and any serial numbers) in a spreadsheet so you have an equipment inventory for both insurance and tax purposes.

For rentals, keep copies of your invoices or receipts in a safe place so you can access them during tax time. Or, if you don't trust your paper filing system, digitize your receipts and save them to the Cloud. Running a photography business also means making some pretty hefty investments in venue or studio spaces. If you've rented out any spaces for photo shoots, remember to deduct those costs on your taxes. And if you rented (or still rent) an area for equipment storage, you can deduct that cost as well. Additional training and courses you take to upgrade your skills can give you a nice tax break — so be sure to deduct the costs of your courses on your taxes. That also includes industry conferences where you go to learn from and network with your peers. Don't forget to account for how you got there (mileage or airfare) and any hotel arrangements. The educational deductions don't stop there either. Professional photo editing software, reference materials like magazines and books, and any annual membership costs may also be deducted if it relates to training and education. As a freelance photographer, travel expenses can add up quickly — which is why it's important to keep detailed records of each trip so you can accurately deduct those costs on your taxes. Travel expenses can include mileage, airfare, car rentals, lodging, cab fares, meals, entertainment and even a portion of your car insurance. Just be aware that the IRS has specific parameters that dictate how much you can deduct from these costs. And the one travel expense most freelancers forget? "Mileage to purchase supplies," Lytton says. Even the smallest detail counts. Regardless of whether you rent or own your home, you can still deduct the cost of your home office space. And in 2013, the IRS actually made this deduction easier for Americans by providing a simplified way to determine this deduction: $5 per square foot, up to 300 square feet. You may even be able to deduct a portion of your rent, mortgage interest, insurance and utility costs—but always check with a professional before deducting these expenses on your taxes. One thing you definitely shouldn't forget: office supplies. A few other expenses Lytton says are commonly forgotten fall under this category: licenses, website fees and, surprisingly enough, tax preparation costs. Along with those, you can also deduct legal fees (if you have a lawyer, for example), insurance costs and promotional expenses. If you accept payment through websites like PayPal or Square, you're more than likely hit with a small fee for payment processing. The good news? You can deduct those transaction fees, too. Since your expensive photography equipment can be used for longer than a year, it's considered a capital expense. Capital expenses or expenditures are essentially purchases that are investments in your photography business. For these kinds of purchases, there are two ways to deduct them on your taxes using Form 4562: If you choose not to list your equipment as listed property on your taxes, you might be eligible for a depreciation allowance. The IRS describes this as "an annual allowance for the wear and tear, deterioration or obsolescence of the property." If you're self-employed, you're eligible to deduct personal costs on your taxes as well. These may include any paid insurance premiums, and a portion of your social security and Medicare taxes, also known as the Self-Employment Tax. Aside from the 1040-ES form, there are several others to consider before you do your taxes in the U.S. As a freelance photographer, many of these forms will be directly related to the types of deductions you can make on your return. The 1040 is a basic tax form for inputting your gross income, deductions, and tax credits. Think of this form as the mandatory front page of your return. Schedule C is the form to report income and expense. It includes your income, business expenses as it relates to your home, costs of goods sold, vehicle information and other expenses not otherwise included. This form must be submitted with the Schedule C form and should be used to determine your social security and Medicare taxes for the year. The form also comes with a flowchart to help you determine if it best fits your tax situation. If you've received or are planning to receive a W-2, use this form to write off your business expenses instead of the Schedule C. With this form, you can account for meal, travel, vehicle, and travel expenses. If you use part of your home for freelance photography such as photo editing tasks, you can use Form 8829 to write off a portion of your rent or mortgage as it relates to the size of your home office. This form is important to remember if you want to write off the depreciation costs of expensive equipment like cameras, lenses, and lighting. But before you start randomly writing off costs, understand how to properly depreciate your property. Here are the three most common methods: For additional resources, refer to Publication 946, How to Depreciate Property and ask a professional. If you're not based in the U.S., check out these resources to help you determine which forms and info best fit your needs for filing your taxes: United Kingdom Australia Canada Once your forms are ready to go, you can submit them. This is usually done online or via mail. The IRS states that if you owe less than $1,000 “after subtracting [your] withholding and refundable credits, or paid withholding and estimated tax of at least 90% of the tax for the current year or 100% of the tax shown on the return for the prior year, whichever is smaller,” you may not need to make quarterly estimated payments. If you expect to owe more than $1,000 on your taxes, you might need to make estimated quarterly tax payments. If this applies to you, start by familiarizing yourself with the 1040-ES form—it’ll be your main tool for estimating what your tax payments will be. According to the IRS, you'll first need to figure out your expected adjusted gross income, taxable income, taxes, deductions and credits for the year. If this still sounds like jargon to you, reference last year's tax return to find this information. Quarterly estimated payments are based upon the income from your prior year. If income increased dramatically over the prior year, you might increase the amount remitted each quarter. The 1040-ES form will be your best friend when it comes to determining your quarterly tax payments. This form will walk you through the scary math formula to determine your quarterly payments based on your expected income for the year. Also remember that if you estimate too high or too low for one quarter, you can always fill out the 1040-ES worksheet again for the next. With some trial and error, you can get a more accurate estimate. Lytton also recommends to keep your payment vouchers in a safe but easy-to-find spot to help you remember when they're due. For additional tips on making your quarterly tax payments, check out the IRS guide on the subject. If this process still feels a little overwhelming, consider hiring an accountant to simplify making your quarterly payments. For example, Lytton's system provides a payment schedule that has amounts and payment due dates. Whether you pay freelance tax quarterly or annually, you'll have to set aside enough cash to cover your bill when tax time rolls around. But how do you know you've budgeted enough? If you set aside too little, you'll be scrambling to find more cash to cover the difference. But budgeting too much toward taxes means you're diverting dollars away that could be allocated to upgrading your skills or equipment. Saving ahead of time for freelance tax takes a little simple math and a lot of discipline. A common rule of thumb is to save around 30% of your income toward freelance taxes. But take a breath and swallow that sticker shock. Yes, 30% sounds like a lot—but remember, this number covers both your income taxes and self-employment taxes and isn't applied to your gross income. Instead, you set aside 30% of your taxable income, which is your freelance income minus all your business expenses (just add up all the deductions we just talked about above). For example: Let's say you're a freelance photographer and your gross monthly income is $5,000. Your total monthly expenses add up to $1,500. So, the formula to get your taxable monthly income would look like this: Total income - business expenses = taxable income $5,000 - $1,500 = $3,500 From there, apply the 30% rule to estimate how much you should set aside monthly in taxes. $3,500 x .30 = $1,050 From here, you'd hypothetically put aside $1,050 per month. A simple way to set aside this cash is to transfer all your tax funds into a savings account you've earmarked just for that purpose—that way, you don't accidentally spend it. Based on the example, it may be tough to set aside $1,050 in one fell swoop each month to cover your freelance tax. Rather than moving that tax cash into savings on a monthly basis, some freelancers prefer to take a portion of each paycheck they receive instead. The same formula above would apply—you'd simply plug in the amount from each client payment (minus expenses, of course). The amounts are far smaller and might be a little less painful to set aside. Before you jump into the ins and outs of prepping for tax season, determine if your freelance photography endeavors can legally be considered a legitimate business. In the U.S., the Internal Revenue Service (IRS) takes this seriously, since photography is a hobby for so many. You’ll want to ensure you can prove you’re running an actual business. If you haven't already, consider a business license. The good news is that freelance photography does not require a federal license in the U.S., as photography isn't regulated by a federal agency. And this might even be the case for state business licenses—but always look into your state's requirements before skipping this step. To go even further, photography as a business activity isn't regulated in many countries, but again always do your homework to find out what's required in your specific country. Generally, U.S.-based freelance photographers should consider forming a limited liability company (LLC) business structure. This is one of the easiest, most flexible ways to protect you and your business, especially within a partnership or as a sole proprietor. If you form an LLC and you only have one member (you, the business owner), you can skip having to complete a corporate tax return and instead claim your income and expenses on your individual tax return. And it goes without saying that you also get legal protection and may look more favorable to future clients if you demonstrate that you take your business seriously.

Once you have your LLC set up, you'll want to set up a bank account that's separate from your personal finances. Depending on your needs, you can approach a financial institution like a bank or credit union to open a business checking or savings account.. If you're a one-photographer show based in the U.K., you can register as a sole trader. However, while you're allowed to keep all income made through this structure, you're still liable for all debts. Another option is to form a private limited company (Ltd.) — this is a good idea if you don't have employees and want the added benefit of liability. You might consider hiring a professional accountant or bookkeeping expert to help you through the entire freelance tax process. A professional tax preparer has the knowledge to assure all income and expenses are taken to mitigate your tax liability. Plus, there is a lot of incorrect information floating around regarding freelance tax. Tax law is complicated and a tax pro will be able to determine how the laws apply to your specific situation to help minimize your tax obligation. How exactly do you find a well-versed accounting pro? Beyond some heavy Googling, you have a few options to source an accountant seasoned in preparing returns for freelancers: With a professional by your side and good bookkeeping practices, you've laid the foundation for success. Now, you'll want to familiarize yourself with everything else you need to know about how to prep and file your taxes as a freelance photographer. Now that you've got a clear idea of what you need to prep for your taxes as a freelance photographer, there are still several things to remember for filing your taxes and how to maintain good bookkeeping practices throughout the year: Path and its affiliates do not provide tax, legal or accounting advice. This material has been prepared for informational purposes only and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction.

Normally, if you're filing as a single person and you're under the age of 65, typically you have to earn a minimum of $12,000 a year to be required to file income taxes. But that number is far lower for freelance photographers and other business owners in the U.S. In fact, if you make $400 or more in income, you'll also need to pay self-employment taxes to the tune of 15.3%. That percentage covers Social Security and Medicare taxes that your employer would normally withhold, as well as the portions of those taxes your employer would normally pay to Uncle Sam directly. Depending on how much is owed, freelance photographers also don't pay their taxes once a year like you do with personal income taxes. Instead, you'll need to prepare for quarterly payments for your freelance tax. You should set aside around 30% of your income toward freelance taxes.

As the saying goes, ‘Garbage in, garbage out.'

Know which business expenses qualify as tax write-offs

Equipment expenses

Studio or venue spaces

Educational costs

Travel expenses

Home offices

Business costs

Transaction fees

Depreciation and repair costs

Self-employment costs

Get the required tax forms

1040

Schedule C

Schedule SE

Form 2106

Form 8829

Form 4562

Organize estimated quarterly freelance tax payments

Tips for handling taxes as a freelance photographer

Set aside money for taxes throughout the year

Prove you’re a legitimate business, not a hobby

Quick tip: One popular method to set up an LLC in the U.S. is through LegalZoom.com

When in doubt, leave it to a pro: how to hire an accountant

Best practices before filing your taxes as a freelance photographer

How to file taxes as a freelance photographer FAQs

What can you write off as a photographer?

What’s the minimum you need to earn to file freelance photographer taxes?

How much should you set aside for taxes as a freelance photographer?